Digital VAT Submission

You can submit your VAT return digitally to HRMC's making tax digital gateway with a single click from your MTD VAT dashboard.

How to do a digital VAT submission

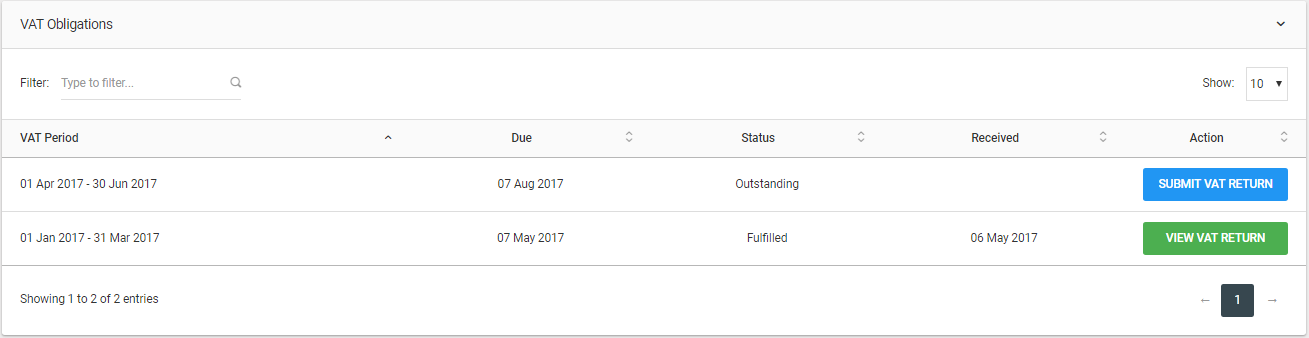

In your MTD VAT dashboard area, go to the top section on the page which lists the VAT obligations as below.

You will have a "SUBMIT VAT RETURN" button for each outstanding VAT obligation.

Assuming that you have successfully mapped the data from your excel spreadsheet to this VAT obligation, click on the "SUBMIT VAT RETURN" button.

Clicking on the button which show a popup as show below.

You will see that the data from the excel spreadsheet that you have mapped is populated with the digital link and ready for your review and submission.

Click on the "SUBMIT" button to submit this VAT return digitally to HRMC's making tax digital gateway.

You will receive a response from HRMC in real time about your submission to tell you if your submission was successfully received or if there were any errors in the submission.