View MTD VAT Dashboard

To view your MTD VAT dashboard, you will have to click on the "VAT Dashboard" link under MTD VAT section from the left side navigation area in your AccountsDesk account.

MTD VAT Dashboard Sections

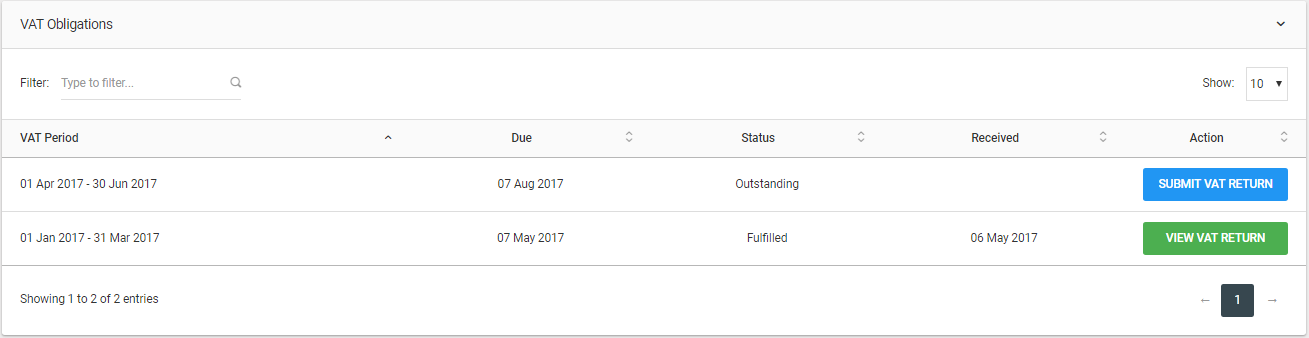

VAT Obligations

The first section on the MTD VAT dashboard page displays the VAT obligations for the business. This VAT obligations data includes - the VAT period, due date for the returns for that VAT period, the status of the vat returns and an option to either view or submit VAT return for the period depending on its current status.

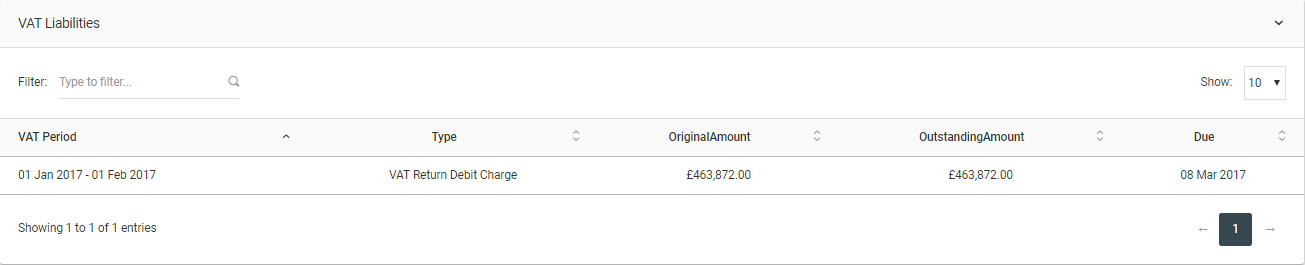

VAT Liabilities

The second section on the MTD VAT dashboard page displays the VAT liabilities for the business. This VAT liabilities data includes - the VAT period, type of liability, original amount, outstanding amount and the due date for that liability.

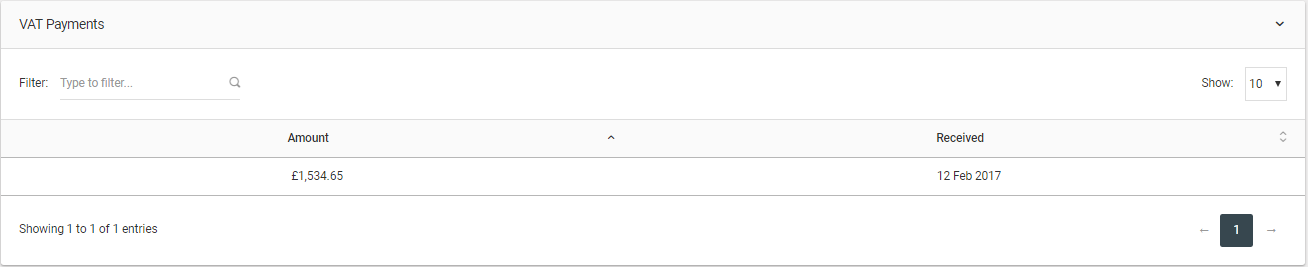

VAT Payments

The last section on the MTD VAT dashboard page displays the VAT payments received by HMRC for the business. This VAT payments data includes - the amount and the date the payment was received by HMRC.

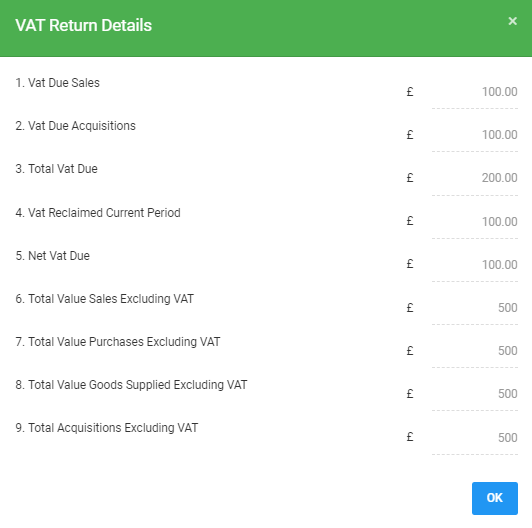

View VAT Returns

You can view your submitted VAT returns from your VAT dashboard. To view a return you will have to click on the "VIEW VAT RETURN" button for the VAT period you would like to view from the VAT obligations section mentioned above.

Clicking on the button, will connect to HRMC's making tax digital gateway and get the VAT returns data. The VAT returns will be displayed in a popup as shown below.